Today’s Average Mortgage Rates Inch Higher

This article is written by Leslie Cook

The average interest rate for a 30-year fixed-rate mortgage is now at 6.171%, an increase of 0.232 percentage points from last week’s ending rate.

Rates were higher for all loan categories, with the 15-year fixed-rate mortgage averaging 5.06% and the 5/1 adjustable-rate mortgage averaging 4.508%.

- The latest rate on a 30-year fixed-rate mortgage is 6.171%. ⇑

- The latest rate on a 15-year fixed-rate mortgage is 5.06%. ⇑

- The latest rate on a 5/1 ARM is 4.508%. ⇑

- The latest rate on a 7/1 ARM is 4.676%. ⇑

- The latest rate on a 10/1 ARM is 4.856%. ⇑

Money’s daily mortgage rates are a national average and reflect what a borrower with a 20% down payment and a 700 credit score — roughly the national average score — might pay if he or she applied for a home loan right now. Each day’s rates are based on the average rate 8,000 lenders offered to applicants the previous business day. Freddie Mac’s weekly rates will generally be lower since they measure rates offered to borrowers with higher credit scores. Your individual rate will vary depending on your location, lender and financial details.

Today’s 30-year fixed-rate mortgage rates

- The 30-year rate is 6.171%.

- That’s a one-day increase of 0.232 percentage points.

- That’s a one-month decrease of 0.329 percentage points.

The 30-year fixed-rate mortgage is the most popular home loan in America: The payback period is long, monthly payments are relatively low and the interest rate you pay never rises.

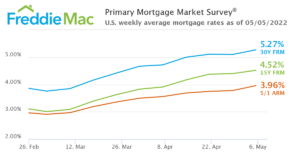

Mortgage interest rates for the week ending May 5, 2022